Click the link below the picture

.

President Trump’s intensifying standoff with European leaders over the fate of Greenland prompted a sharp response from investors Tuesday, with the value of U.S. stocks, the dollar, and government bonds all falling.

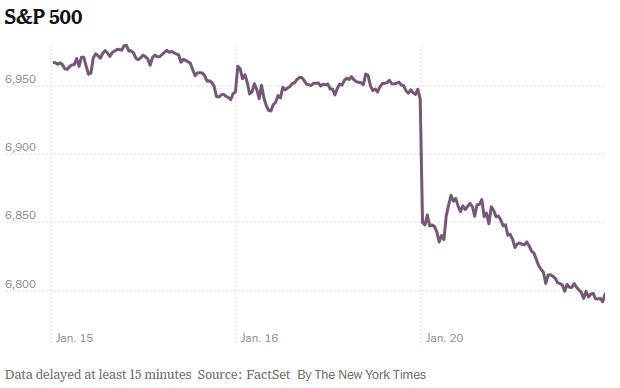

The S&P 500 dropped over 2 percent for the first time since October, as investors reacted to Mr. Trump’s increasing threat of higher tariffs on European allies unless they supported his plans for America to take control of Greenland. The Vix volatility index, known as Wall Street’s fear gauge, rose to its highest level since November.

Tuesday’s opening decline was the index’s biggest since April, when Mr. Trump first proposed sweeping tariffs on nearly all of America’s trading partners. And while the sell-off remained contained for now, with the S&P 500 still close to its record high, the moves showed a clear increase in investor concern over the future of the established world order. Investors had become inured to geopolitical upheaval in recent years because it has typically had little impact on corporate profits.

Investors’ confidence wavered on Tuesday even as Mr. Trump boasted about a long list of embellished achievements in remarks to reporters, among them the strength of investments in the United States and the stock market’s returns over the course of his first year in office.

“We have the hottest country in the world right now,” Mr. Trump said.

The moves in financial markets told a different story. Often when stocks are roiled by geopolitical upheaval, investors flock to the safety of other U.S. assets, like the dollar or government bonds. But in a sign that investors were embracing a “sell America” trade and moving away from U.S. assets altogether, both the dollar and U.S. government debt lost value on Tuesday.

Eric Teal, chief investment officer at Comerica Wealth Management, said investors should be “playing defense at this juncture,” focusing on geographic and sector diversification while the current uncertainty lingers.

The dollar index, which pits the currency against a basket of currencies that represent America’s major trading partners, fell 0.8 percent. The dollar weakened against the euro, British pound, and Norwegian Krone.

The Swiss Franc, another haven in times of uncertainty, strengthened almost 1 percent against the U.S. dollar. Gold and oil prices also climbed higher, with the precious metal up 1.8 percent in another sign of investor caution.

The 10-year U.S. Treasury yield, which moves inversely to price, also rose, meaning its value declined. This yield acts as one of the most important interest rates in the world by underpinning interest rates across consumer and corporate debt.

The yield rose to its highest level since August, undermining the administration’s efforts to move interest rates lower. Scott Bessent, the Treasury secretary, pointed to rising bond yields in Japan as a factor helping push U.S. yields higher.

Andrew Brenner, head of international fixed income at National Alliance Securities, said that Mr. Trump “has a path to lower rates and less controversial path with Greenland, but the question is will he take it?” He warned investors on Tuesday to expect “major volatility.”

Tuesday’s trading was the first chance U.S. markets had to react to Mr. Trump’s escalating threats toward Europe over the weekend with the U.S. stock market closed on Monday in honor of Martin Luther King’s Birthday.

Despite the modest sell-off, major stock indexes remain close to record highs after a third consecutive double-digit rise in 2025.

Commerce Secretary Howard Lutnick, speaking on a panel discussion at the World Economic forum in Davos, Switzerland, on Tuesday, defended the Trump administration’s “America First” policies even as it has rattled investors and trading partners.

“Everyone said, ‘You are going to do all these tariffs, you are going to destroy the world,’” he said. “The world’s stock markets are up. Which ones of them? All of them.”

Investors have mostly looked through geopolitics in recent years, as the tangible detrimental effect to corporate profits has been limited. The sharp moves on Tuesday suggest a heightened nervousness among investors about the administration’s persistent pursuit of a European ally’s territory.

European stock markets also fell on Tuesday, with bourses in Germany, France, and the United Kingdom all moving roughly 1 percent lower.

.

Stock Drop– Greenland

Stock Drop– Greenland

.

.

Click the link below for the complete article {sound on to listen}:

.

__________________________________________

Leave a comment